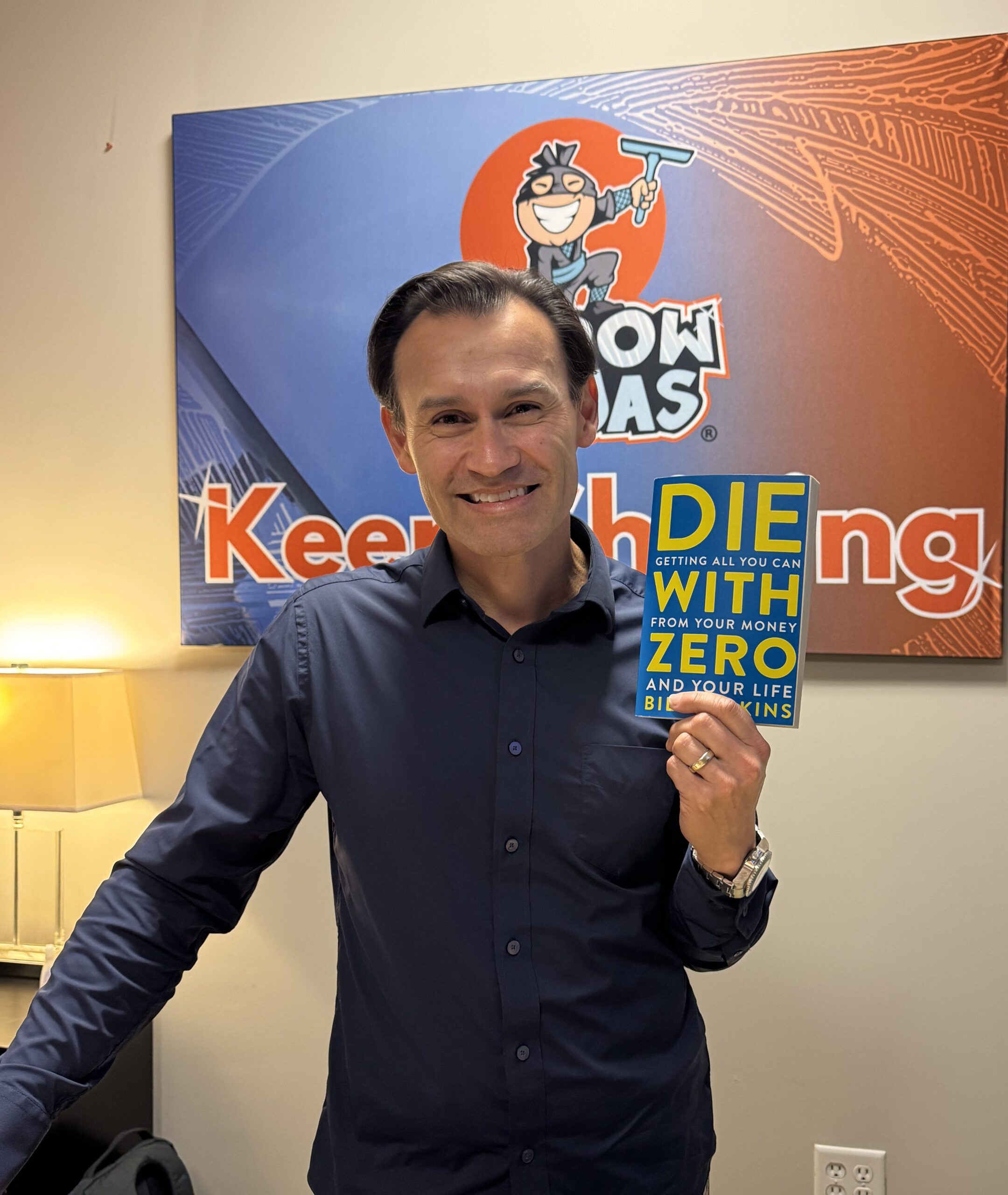

Alright, my fellow adventure-seekers, here’s the deal. If you’ve been looking for a book that shakes up how you think about time, money, and what it really means to live, Die With Zero by Bill Perkins is it. Honestly, I might not have given this book a second glance if it weren’t for my brother-in-law. He’s the guy you go to when you need life advice served with a side of sharp wit, and he came to me one day, absolutely raving about this book. Said it had completely reframed how he sees life and money. I trust the guy, so I gave it a shot. And you know what? He was spot on. Die With Zero hit me harder than a Mike Tyson right hook. And here’s why I’m urging you to give it a read.

Perkins drops a wild idea right off the bat! Spend your cash with the intention of dying with zero in the bank. I hear ya Bill! The thought of running out of cash sounds like it belongs in a nightmare, not a life strategy. But y’all hold on to your squeegees because this isn’t about blowing through your savings and hoping for the best. It’s about flipping your mindset and asking yourself, “Self, what’s the point of hoarding money if we’re too old, too tired, or too ‘meh’ to actually enjoy it?”

My brother-in-law had a way of summing it up when he recommended the book to me. “Think about it,” he said. “What’s the use of saving for a rainy day if it leaves you too worn out to actually dance in the rain?” That stuck with me. Once I dove into the book, I realized that Perkins isn’t suggesting a free-for-all spending spree. Instead, it’s about being intentional with how you use your money to create a life full of meaning, not just numbers on a bank statement.

Invest in Memories, Not Just Money

Perkins does an incredible job breaking down why experiences are worth so much more than material things. Think about it: you’ve spent decades working hard, saving diligently, and one day you look at your bank account and think, “Wow, I did it!” But then you realize you’ve spent so much time saving for “one day” that you’ve postponed living. Suddenly, those big bucket-list dreams, like hiking in Patagonia or skydiving over the Great Barrier Reef, don’t feel as easy to tackle. Time may have been kind to your savings account, but not necessarily to your ability to do those once-in-a-lifetime activities.

Here’s the gem Perkins throws our way: there’s a sweet spot to making memories. Experiences have a timeline, and our ability to enjoy them evolves over the years. The way I see it, our physical and emotional capacity to seize the day isn’t infinite. When you’re young, you’ve got the energy and stamina for those adrenaline-pumping adventures. When you’re older, sure, there’s still plenty to enjoy, but some doors start to close. It’s like the final call on a Black Friday sale. If you wait too long, you might miss the best deals on life’s experiences.

The “Memory Dividend” A Different Kind of ROI

Now, this is one of my favorite parts of the book. Perkins introduces the concept of the Memory Dividend. The idea is simple but genius. When you spend money on meaningful experiences, you’re not just paying for that one moment of joy. You’re creating memories that will keep paying emotional dividends for years to come.

Think about it. Remember your last family vacation or that road trip with friends? Odds are, the laughs and stories from those moments still bring a smile to your face. Those are the “payments” you keep getting from that experience. And honestly, wouldn’t you rather smile about the time you got lost trying to find the biggest ball of twine in the world than brag about how much interest your savings account accrued last year?

This concept hit home for me. If there’s anything I’ve learned from being in the window cleaning business, it’s this: it’s not just about having the cleanest windows in the neighborhood. It’s about enhancing the view. And life works the same way. If you’re not making choices to create a vivid, colorful outlook filled with memories and experiences, are you really living? Perkins pushes you to ask yourself that question.

Don’t Just Save. Spend Wisely

One of the biggest lessons here is to rethink how we approach saving and spending. Perkins doesn’t tell you to throw your budget out the window, but he does suggest creating a spending plan for life. This plan isn’t about restricting yourself. It’s about giving yourself permission to say “yes” to the opportunities and adventures that excite you.

Here’s a reality check that really stuck with me. Perkins explains that we often overestimate how much money we’ll need later in life, leading to excessive saving at the expense of living in the moment. Look, I’m a planner. I love setting goals and taking care of my future. But Perkins opened my eyes to the fact that while money can always be earned, time is a one-way ticket. You don’t get a refund on missed opportunities.

That nugget, my friends, hit me like a thunderbolt. I started reimagining my own goals. Sure, scaling Mount Everest once sounded amazing, but who says I can’t create incredible adventures closer to home? A weekend hike, a day trip to a nearby city, or even trying out a new hobby can provide just as much joy. You don’t need to go broke to create excitement and fulfillment. But you do have to keep in mind, every window will close on you faster than you imagining yourself sailing around the world! You may have the physical and mental ability to do it today, but what about tomorrow……….or next year? Think about it!

Leaving a Legacy That Really Matters

Now, if you’re sitting there thinking, “Okay, but what about leaving something behind for my family?” I hear you. One of the things Perkins addresses beautifully is the idea of legacy. He challenges us to rethink what it means to pass something on to our loved ones. Instead of focusing entirely on financial inheritance, why not focus on creating a legacy of love, stories, and shared moments?

Imagine your kids telling their kids about the time you took them on a spontaneous cross-country adventure. Or how you taught them to clean windows while regaling them with wild tales of your greatest exploits. Those are the things that stick. At the end of the day, the wealth that truly matters isn’t measured in dollars. It’s reflected in the laughs, lessons, and experiences you leave behind.

Why You Should Pick Up This Book Today

If you’re sitting on the fence about Die With Zero, give it a shot. I’ll say this: Perkins’ ideas aren’t for everyone. But if you’ve ever felt like you’re stuck in the grind, waiting for “someday” to start living your dreams, this book could be the nudge you need. It’s packed with practical insights and thought-provoking ideas. Sure, it’s not the funniest book you’ll ever read, but it makes you laugh a little and think a lot.

I give it a solid 4.5 out of 5 squeegees because it’s that good. I docked it just a tiny bit because I think Perkins could’ve added a bit more humor. I mean, when you’re talking about spending all your money and dying with nothing left, there’s room for a few extra laughs, right? The message is profound, but a touch more wit would’ve made the read even better.

That said, this book is a call to action. It’s a wake-up call to chase the experiences that matter, invest in the people you love, and make the most out of the time you’ve got. Whether you’re already good at living in the moment or need a little push, Die With Zero will give you some honest-to-goodness tools to live fully and intentionally.

Life’s too short to wait around. Don’t live with windows so fogged up by routine that you miss out on the beauty around you. Clear the glass, take a good look, and start prioritizing what really matters. Pick up Die With Zero, get inspired, and go chase those moments that make life richer. Because when it’s all said and done, the real wealth lies in the memories you create.

Keep those windows clean and your adventures wild, my friends. Here’s to living a life so full of stories that even Father Time tips his hat and says, “Well done!”